The Process

We will operate within the framework of a Four Step Investment

Process. It is designed to

bring structure and discipline to the ongoing decision-making of your strategy.

A disciplined investment process will promote appropriate responses to changing individual

financial circumstances and periods of volatile financial markets. The ultimate success of your

investment strategy in meeting your long-term objectives will be determined by:

- Developing a clear understanding of your goals and objectives;

- Properly aligning your investable resources consistent with these objectives;

- Eliminating an emotional response to perceived short-term investment opportunities and market volatility.

Financial Analysis

A sound investment strategy begins with the establishment of your current financial position. We have analyzed your financial circumstances, including available resources, investment time horizon, liquidity needs, rate of return objectives and risk tolerance. Based on your answer, our discussions and investment preferences, your overall investment objectives and risk tolerance is consistent with our Moderate Profile.

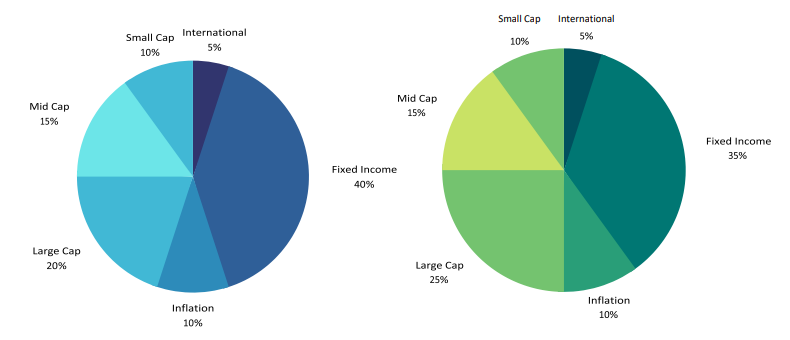

Asset Allocation Modeling

Asset Allocation is the process of allocating your investment capital to specific

asset

classes to maximize expected returns for a given level of risk. It is essential that you

understand the relative importance of asset allocation versus security selection, market

timing and other factors in determining portfolio performance.

Asset Allocation is at the heart of our asset management approach. Academic studies by

Brinson, Hood and Beebower, (1986); and Brinson, Singer and Beebower, (1991),

concluded that over 90% of portfolio performance results from the asset allocation

decision and all other factors have only marginal impact.

In 1990, Harry Markowitz won the Nobel

Peace Prize in Economic Sciences for his extensive research in Asset

Class Behavior and Portfolio Analysis. His findings are commonly referred to as Modern Portfolio

Theory and

his work has had a profound influence on the world of modern finance and investment management.

Modern

Portfolio Theory offers a more in-depth analysis of the performance of asset classes. In addition to

analyzing

historic returns and volatility, the Theory adds a third dimension to portfolio management that

evaluates asset

class's diversification effect on a portfolio. This shifts the attention away from individual

securities and toward

a consideration of the portfolio as a whole.

We employ a strategic asset allocation approach to our portfolios. This approach tends to maintain a

more

static asset mix throughout the investment time horizon. The asset mix is determined based upon your

risk/return parameters. Once the asset mix has been established the portfolio is rebalanced when the

targets

percentages are violated by a pre-determined amount to maintain a constant level of risk exposure

throughout the investment period. In addition, our system is capable of gradually increasing the fix

income

target over time. The use of this option creates a custom target date fund designed to provide a

simple

investment solution through a portfolio whose asset allocation mix becomes more conservative over

time.

Portfolio Monitoring and Rebalancing

Portfolio monitoring and rebalancing is the other and equally important component

of Modern

Portfolio Theory. The primary goal of a rebalancing strategy is to minimize risk relative to a

target

asset allocation, rather than to maximize returns. A portfolio’s asset allocation is the major

determinant of a portfolio’s risk-and-return characteristics. We monitor the asset mix in your

portfolio at the end of each trading day and intraday during periods of extreme volatility, to help

insure that your asset allocation stays on target.

We measure the allocation of your investments in the following four ways:

- Fixed Income & Inflation Hedge vs Equity & Alternative Investment

- Value Equity vs Growth Equity

- By major asset classes

- By all 18 Asset Classes

Reporting

We employ an unprecedented proprietary investment system to define and execute your investment strategy. A registered broker/dealer and FINRA/SIPC member will execute all trades and act as the custodian of your account. We will place all transactions directly with the selected broker/dealer and the custodian of record will provide all trade confirmations, monthly brokerage statements,